0 Comments

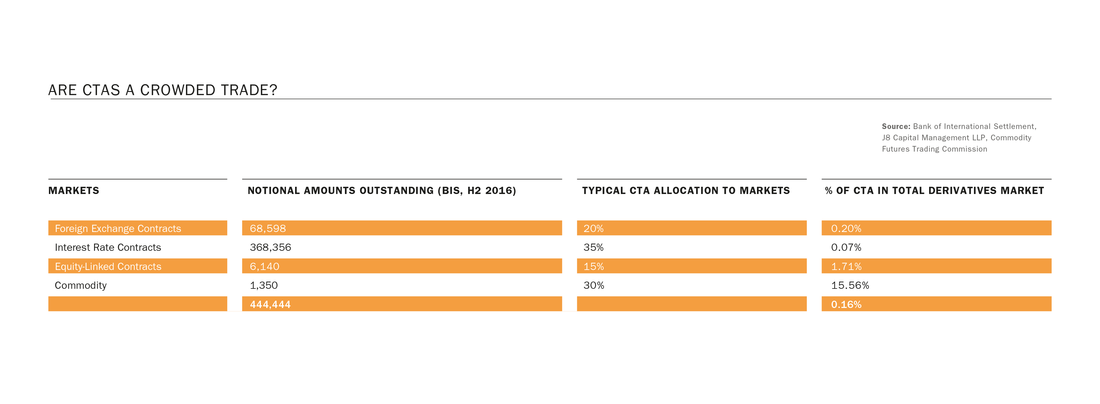

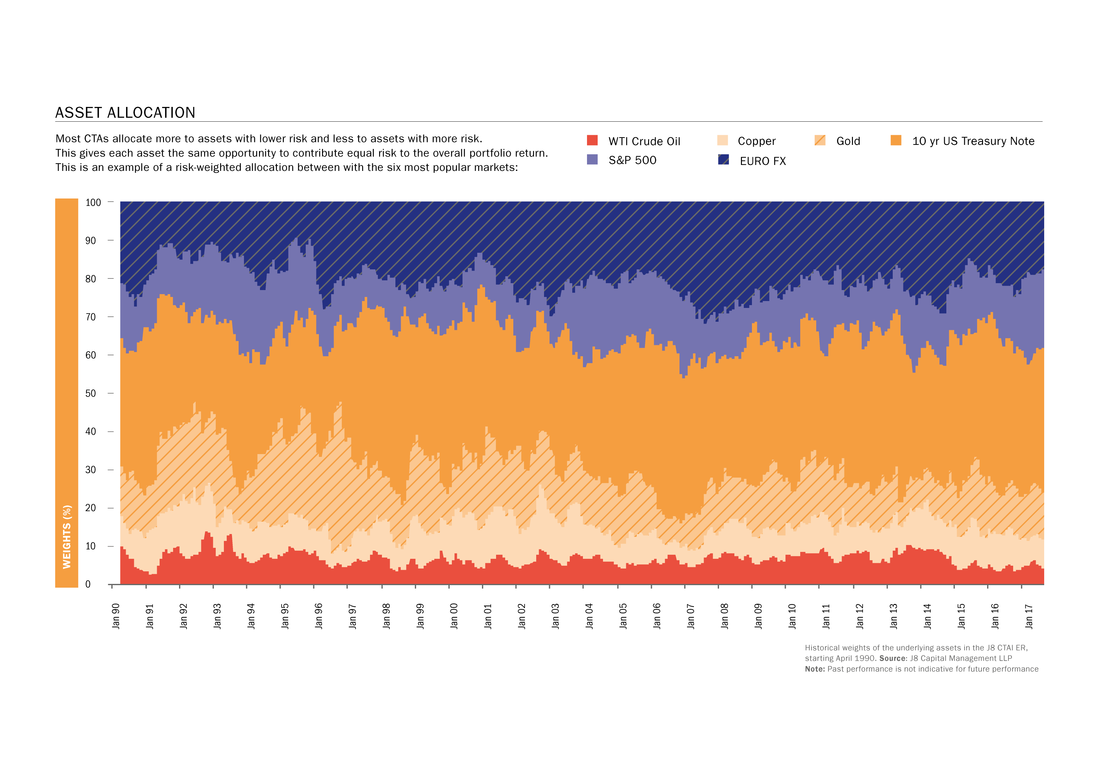

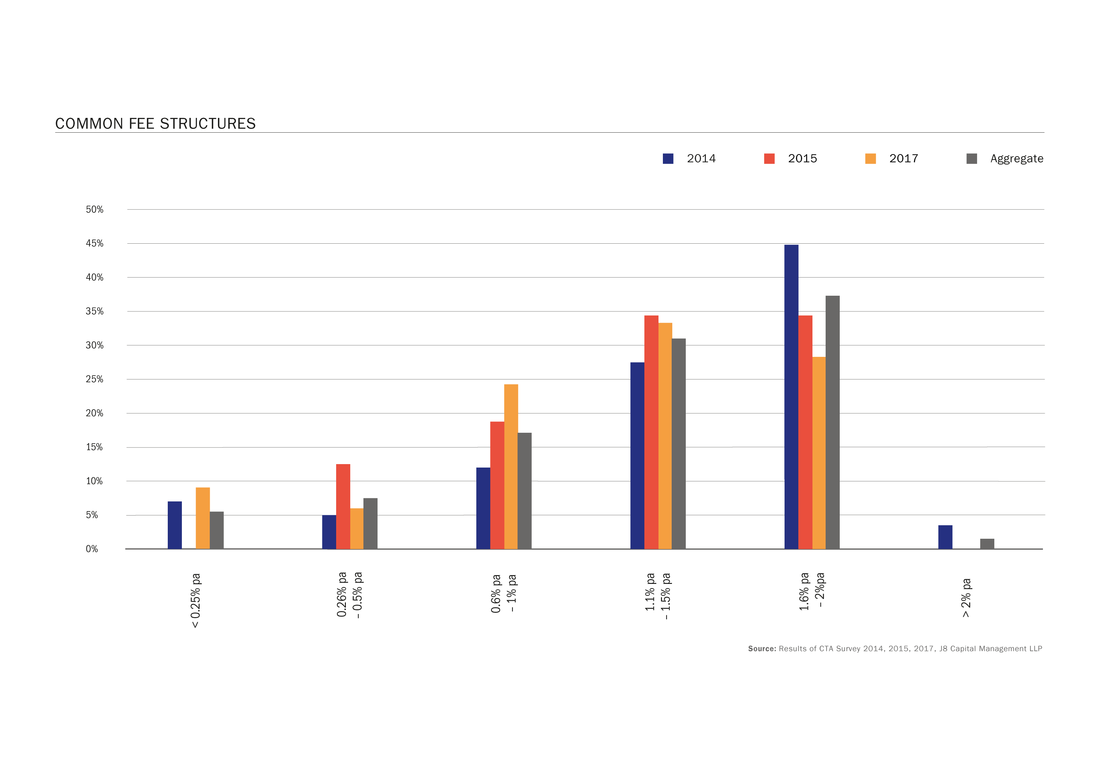

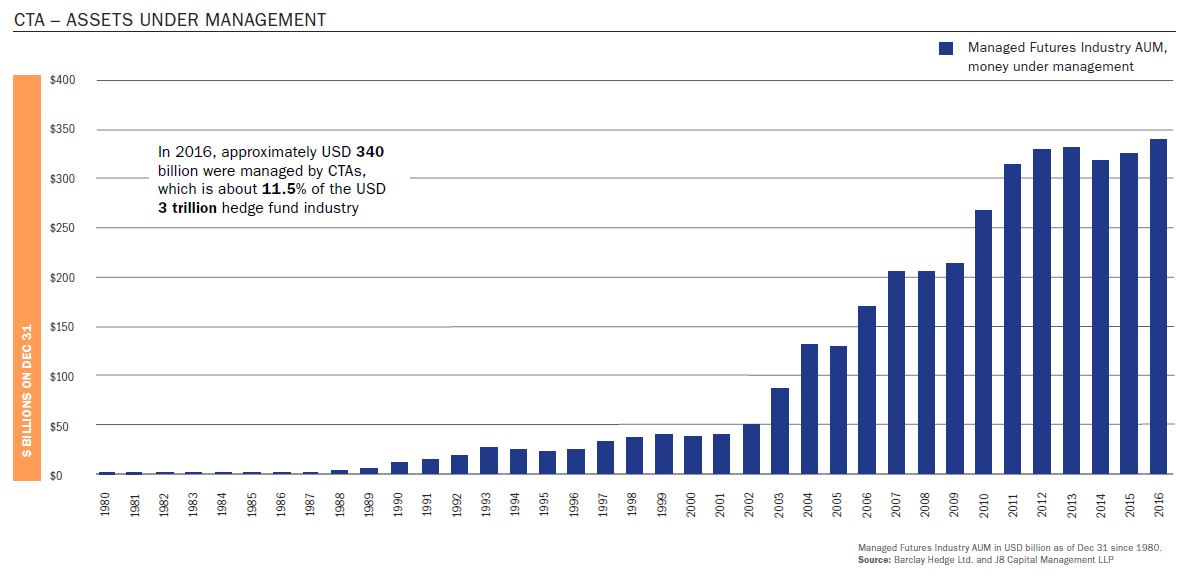

On 25th September 2017, the Alternative Investment Management Association (AIMA) and Societe Generale published a paper on CTAs: "Riding the wave - Why you should consider allocating to CTAs". It highlights investor benefits, performance characteristics, sector characteristics, and popular misconceptions associaed with Managed Futures investing. Earlier this year, we were invited to review and provide comments, which we did.  We concluded that in relations to the global total derivatives markets, CTAs take such small and dissimilar positions that they do not pose liquidity risks when it comes to simultaneous unwinds. Story: Recently, an investor asked if investing in CTAs was investing in a crowded trade. We think not! A) According to the Bank of International Settlement (BIS), the total notional outstanding in derivatives in 2016 was $444 trillion. CTAs manage approximately $350 billion assets under management (BarclayHedge). Assuming an average leverage of 200% across the CTA and Managed Futures industry (CTA survey), CTAs manage approximately $700 billion in notional outstanding. CTAs only make 0.16% of the total notional outstanding in derivatives. B) Looking at segments and the most crowded: The typical CTA allocation holds 35% in bonds/interest rates, 30% in commodities, 20% in currencies, and 15% in equity linked derivatives (CTA survey). According to BIS data, commodities are the smallest derivatives segment with total notional outstanding of $1.35 trillion. Using same assumptions as above allocated 15% of total notional outstanding in commodities being held by CTA. This matches CFTC data suggesting about 15% of commodity futures are held by speculators. 15% market share does not constitute a crowded market. Conclusion: In respect of the total global derivatives markets and the US Treasury's definition of a crowded trade, we conclude that CTAs have such small and dissimilar positions that they offer little risk in terms of insufficient liquidity, should market participants seek to unwind their positions simultaneously. CTAs are therefore not a crowded trade. Sources: https://definedterm.com/crowded_trade http://www.bis.org/ http://www.cftc.gov/index.htm https://www.barclayhedge.com/ http://www.j8capital.com/j8-cta-index.html |

AuthorDr. Tillmann Sachs, CIO and Head of Research Archives

January 2018

Categories |

- About

- J8 GARS

- Regulatory Hosting

-

Research

- J8 CTA Index

- Videos >

- JII - A liquid and investible benchmark index for the CTA and MF industry

- THFJ - Common Denominators in CTAs: Traded Markets

- THFJ - Common Denominators in CTAs: Portfolio Construction and Index

- JII - Common denominators in the CTA and managed futures industry: A survey report

- THFJ - Correlation is not always what it seems

- Quantifying Political Risks - PhD Thesis

- Contact

|

PRUDENT investment management.

|

PROCESS driven strategy.

|

PERSISTENCE in returns.

|

|

J8 Capital Management LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom

J8 Capital Management LLP is registerred with the National Futures Association in the United States. |

J8 Capital Management LLP (c) copyright 2024

|

RSS Feed

RSS Feed