J8 Global Absolute Return Strategy

|

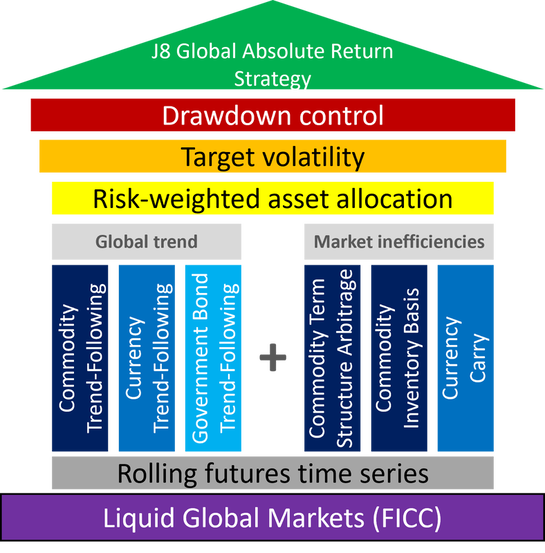

The J8 Global Absolute Return Strategy (“J8 GARS”) is a systematic, liquid alternative investment strategy. Capital growth and downside risk protection are at its core. The program’s uncorrelated returns make it a compelling portfolio diversifier to achieve an improved Efficient Frontier. J8 GARS only trades highly liquid exchange traded futures on commodity, currency, and government bond markets. It has no equity market exposure. It uses trend following, term structure arbitrage, carry trades, and inventory basis to generate returns within a systematic and formulaic investment process which is governed by strict risk management protocols.

J8 GARS has been trading live since 1st January 2015 and continues to outperform liquid alternatives benchmark indices. Returns are uncorrelated to traditional equity and bond markets, as well as to other alternative asset classes. The implementation of J8 GARS is cost efficient with notional funding and low margin-to-equity requirements. The strategy is derived from our proprietary research. |

Strategy description

The J8 Global Absolute Return Strategy (J8 GARS) trades commodity, currency, and government bond futures only. As a systematic program, J8 GARS utilizes trend-following, carry, term-structure arbitrage, and inventory basis signals in a risk-weighted diversified portfolio to systematically generate returns which are managed to a target volatility. It can systematically close-out and reduce exposures in response to changes in the market environment. The signal diversification and strict risk management protocols stabilize the returns, reduce drawdown severity and shorten recovery periods. As such, J8 GARS invests to preserve and grow capital and help diversify alternative and traditional investment portfolios.

The J8 Global Absolute Return Strategy (J8 GARS) trades commodity, currency, and government bond futures only. As a systematic program, J8 GARS utilizes trend-following, carry, term-structure arbitrage, and inventory basis signals in a risk-weighted diversified portfolio to systematically generate returns which are managed to a target volatility. It can systematically close-out and reduce exposures in response to changes in the market environment. The signal diversification and strict risk management protocols stabilize the returns, reduce drawdown severity and shorten recovery periods. As such, J8 GARS invests to preserve and grow capital and help diversify alternative and traditional investment portfolios.

|

|

|

The risk of loss in commodity interest trading can be substantial.